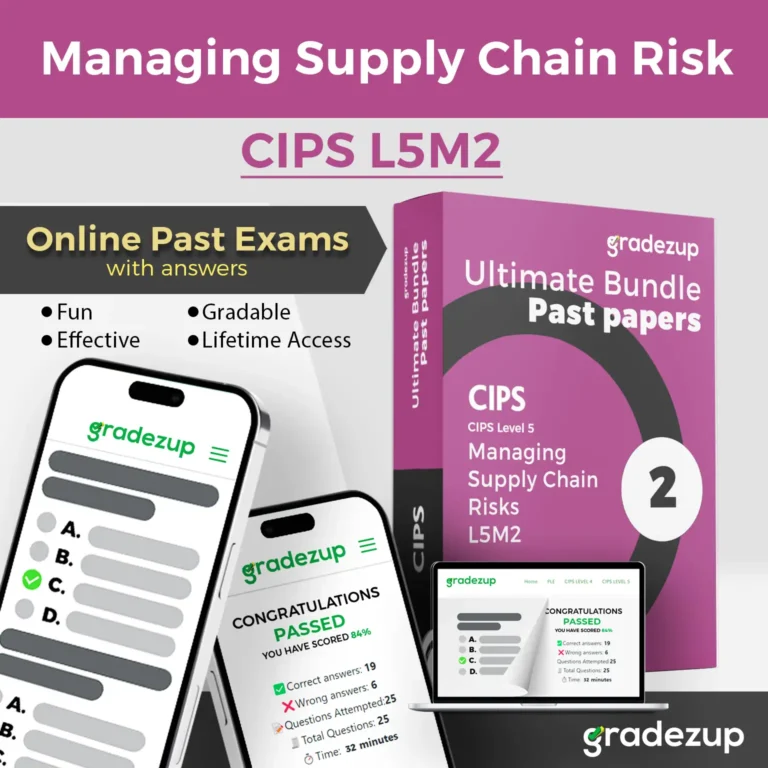

Ready to excel in your CIPS L5M2 Exams

Time's up

✨ Premium Access ✨

🔻 Access more CIPS L5M2 Exam Past Papers 🔻

Note: $4.99 grants you access to all papers (paper 1 – paper 11)

Gain access using

Practice Gradezup Pass L5M2 Exams

Fix access error

Are you having trouble accessing papers after purchase. No worries just submit you account email to reboot the access instantly.

L5M2 Quick Exam-Ready Summary:

- Core Module

- Objective / Response Exam

- 1.5 hours Exam duration

- 60 Questions in exam

- 6 Credits Score

Principles of Risk Management

Definitions, frameworks (ISO 31000, COSO), resilience, governance, risk appetite, global drivers

Risk Identification & Classification

nternal vs external risks, PESTLE/STEEPLED, Porter’s Five Forces, demand, logistics, financial, ESG risks

Risk Assessment & Analysis

Heat maps, probability–impact matrices, risk registers, Monte Carlo, FMEA, supply chain mapping

Mitigation & Management Strategies

Strategies Avoid, transfer, reduce, accept; redundancy, diversification, collaboration, contracts, BCP, DRP

Monitoring & Continuous Improvement

KRIs, dashboards, blockchain, continuous review, lessons learned, reporting, governance integration

CIPS L5M2 Exam Focus Areas – 2025 (Master List)

“These are core learning areas, but CIPS may include questions from other parts of the syllabus.” ⚠️

1. Principles of Risk Management in Supply Chains

- Key Concepts of Risk:

- Definitions: risk, risk management, uncertainty, resilience, robustness

- Categories of risk: pure vs speculative; known vs unknown vs unknown-unknown

- Differences between enterprise risk management and supply chain risk management

- Risk appetite and tolerance within organisations

- Importance of risk culture and governance structures

- Frameworks and Approaches:

- ISO 31000, COSO, and other formal frameworks for risk management

- Supply chain risk maturity models (basic → advanced proactive systems)

- Role of supply chain visibility in enabling effective risk management

- Drivers of Risk in Modern Supply Chains:

- Globalisation and extended supply chains

- Outsourcing and offshoring

- Just-in-Time and lean practices (reducing buffers, increasing exposure)

- Political, environmental, and economic volatility

2. Risk Identification and Classification

- Internal vs External Risks:

- Internal: operational errors, process breakdowns, supplier failure, capacity shortfalls

- External: natural disasters, geopolitical instability, pandemics, cybercrime, regulatory changes

- Risk Categorisation Frameworks:

- PESTLE / STEEPLED (political, economic, social, technological, environmental, ethical, legal, demographic)

- Porter’s Five Forces (impact of buyer/supplier power, competitive intensity, substitutes, new entrants)

- Supply market mapping and segmentation

- Risk Sources in Supply Chains:

- Procurement and sourcing risks

- Logistics and transportation disruptions

- Demand volatility and forecasting errors

- Financial and currency risks

- ESG (Environmental, Social, Governance) and reputational risks

3. Risk Assessment and Analysis

- Assessment Tools:

- Risk registers and heat maps (likelihood vs impact grids)

- Probability–impact matrices

- Risk scoring and prioritisation methods

- Analytical Techniques:

- Qualitative vs quantitative assessment

- Monte Carlo simulation and sensitivity analysis

- Failure Mode and Effects Analysis (FMEA)

- Supply chain mapping to highlight critical nodes

- Prioritisation of Risks:

- Identifying high-impact, high-likelihood events

- Considering low-likelihood, high-impact “black swan” risks

- Developing critical supplier risk profiles

4. Mitigation and Management Strategies

- Strategic Options (the 4Ts):

- Avoid → eliminate risky activities/suppliers

- Transfer → insurance, contractual clauses, outsourcing

- Reduce → process controls, dual sourcing, supplier audits

- Accept → live with tolerable risks

- Tactics in Supply Chain Context:

- Redundancy (extra capacity, safety stock, alternative suppliers)

- Diversification (multi-sourcing, multi-location)

- Collaboration with suppliers for joint risk management

- Contractual protection: indemnities, force majeure, liquidated damages

- Financial instruments and insurance policies

- Business Continuity & Resilience:

- BCP (Business Continuity Planning)

- DRP (Disaster Recovery Planning)

- Crisis management planning and communication strategies

5. Monitoring, Reporting, and Continuous Improvement

- Ongoing Risk Monitoring:

- Key Risk Indicators (KRIs) and dashboards

- Early warning systems, predictive analytics, and IoT monitoring

- Blockchain for secure risk tracking

- Review and Learning:

- Periodic reviews of risk registers and mitigation strategies

- Lessons learned from major disruptions (COVID-19, Brexit, natural disasters)

- Continuous improvement tools: Kaizen, Six Sigma, Lean links

- Governance and Reporting:

- Risk reporting to senior management and boards

- Integration of supply chain risk into ESG reporting and compliance obligations

- Communication with stakeholders and regulatory bodies

View more CIPS Exams

Select the Exams you want to practice